Serves Up Holiday Cheer, But Investors Crave More.webp)

Abercrombie & Fitch capped off fiscal 2024 with a standout holiday performance that exceeded both internal targets and Wall Street’s expectations. The company’s updated fourth-quarter net sales outlook now points to a 7%–8% increase, up from the previous range of 5%–7%. For the full fiscal year, Abercrombie projects approximately 15% sales growth, nudging past the earlier upper limit of 14%–15%.

Chief Executive Officer Fran Horowitz credited “compelling product assortments and targeted marketing” for resonating strongly with holiday shoppers across various regions. “Through fiscal December, we delivered record quarter-to-date net sales, exceeding the expectations we provided in November,” Horowitz noted. “We’re proud to reflect on another year of fulfilling our commitments to both customers and shareholders.”

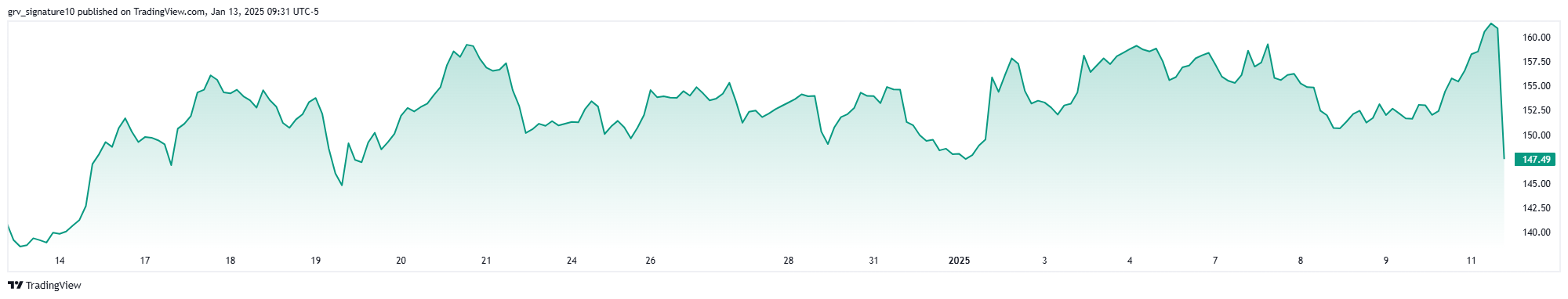

Despite delivering solid numbers, Abercrombie’s share price slid approximately 10% in premarket trading after the announcement. This dip came on the heels of a stunning 66% run-up year-to-date, which had placed Abercrombie among the top-performing retail stocks in 2024.

Analysts point to the company’s decision to hold its operating margin guidance steady at 16% for the fourth quarter and 15% for the full year as the key reason behind the subdued reaction. While net sales soared, some investors had hoped higher revenues would translate into a larger margin upgrade—particularly given the brand’s strong momentum over the past year.

The tempered response highlights a common phenomenon in equity markets: even robust results can disappoint if they fail to exceed heightened expectations. Abercrombie’s stock was already priced to reflect optimism about holiday performance, so maintaining margin targets signaled limited upside for near-term profitability, triggering the premarket sell-off.

Abercrombie’s momentum rests on the pillars of its “Always Forward Plan,” which aims for sustainable, profitable growth through a variety of initiatives:

Horowitz underscored these initiatives’ central role in driving ongoing success: “We remain committed to nurturing our relationship with customers and building on the progress we’ve made in growing our global brands.”

Abercrombie’s stellar holiday sales were met with skepticism primarily because of the company’s steady operating margin forecast. Shareholders had hoped that stronger-than-expected revenue might also spark a margin revision. With inflation and shifting consumer habits affecting profitability industry-wide, a flat outlook on operating margins can signal to investors that cost pressures remain or that promotional activity might still be high.

Additionally, the brand has delivered an impressive stock run in 2024, outperforming many peers. Elevated market expectations can sometimes work against companies—when expectations are already sky-high, meeting them isn’t always enough to satisfy investors looking for that extra push.

Despite its winning streak, Abercrombie isn’t immune to larger macroeconomic and industry-specific headwinds:

Still, the retailer’s leadership team, including Chief Operating Officer Scott Lipesky and Chief Financial Officer Robert Ball, has stressed the company’s preparedness to adapt. They plan to share more insights at the upcoming 2025 ICR Conference, where stakeholders will be eager for details on how the brand plans to convert its top-line success into stable, long-term profitability.

Heading into 2025, Abercrombie’s core challenge is to convert strong sales momentum into healthy, sustainable margins. Horowitz and her team have successfully showcased brand vitality and maintained strong loyalty among key demographics. Now, they’ll need to fine-tune cost structures, streamline operations, and optimize promotional strategies to show the market that big revenue gains can also yield better-than-expected profits.

Abercrombie & Fitch’s record-setting holiday sales offer a definitive statement on the company’s relevance and appeal in a competitive retail market. Although maintaining operating margin guidance steadied some investor enthusiasm, it doesn’t overshadow the retailer’s remarkable comeback in recent years. The stage is set for Abercrombie to demonstrate how it will continue leveraging its robust brand, strategic acquisitions, and agile inventory strategies to deliver enduring growth and profitability well into 2025 and beyond.

Stellar top-line performance can only impress the market for so long—ultimately, shareholders want to see those gains filter down to the bottom line. Abercrombie’s recent results provide an auspicious starting point; translating that energy into sustained profit expansion will be the true test of its staying power.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles