Australian industrial 3D printing company AML3D Ltd (ASX: AL3) has announced a significant milestone in its U.S. expansion strategy, completing the commissioning of its ARCEMY® X 6700 system at the Tennessee Valley Authority (TVA)—the largest publicly owned power utility in the United States.

The successful installation, located at TVA’s Muscle Shoals facility in Alabama, finalises the ~$1.97 million system component of a $2.27 million contract and triggers the release of the final milestone payment. More importantly, the development is a signal that AML3D’s U.S. ambitions are moving beyond defence contracts and into America’s vast energy and utilities sector.

The TVA win represents the first system delivery from AML3D’s U.S. Technology Centre in Stow, Ohio, a facility that was opened as part of the company’s U.S. Scale-Up strategy. Originally launched in 2023 with a focus on supporting the U.S. Navy’s Submarine Industrial Base (SIB), AML3D has since leveraged its growing reputation to service the broader Marine Industrial Base (MIB), including surface ship and munitions manufacturing.

With the successful delivery to TVA, AML3D is now primed to expand into new verticals—including aerospace, nuclear, oil & gas, and utilities.

CEO Sean Ebert commented on the milestone:

“Delivery of the TVA ARCEMY® X order is a strong endorsement of AML3D’s decision to focus on the U.S. and our U.S. Growth strategy. We were always confident we could springboard off our continuing success in supporting the U.S. Defence sector to expand into additional U.S. markets. Even more exciting is the opportunity to use our U.S. playbook to drive growth in the UK and Australia, the AUKUS defence partners and other globally significant markets.”

Notably, AML3D secured the TVA contract after a competitive tender process that evaluated multiple advanced manufacturing solutions. This is not only validation of the company’s patented Wire Additive Manufacturing (WAM®) process but also of its capacity to deliver operational, IIoT-enabled systems at scale.

Pete Goumas, President of AML3D US, underscored this point:

“It’s also great to know that our advanced technology solutions won out when compared to alternatives as part of the TVA’s competitive tender process. We are becoming ever more embedded in the US Navy’s SIB supply chain… with huge opportunities to go after.”

He also revealed that AML3D has received a Letter of Intent indicating the need for up to 100 ARCEMY® systems and 400 parts in 2026, rising to 1,600 parts by 2030—suggesting significant forward momentum.

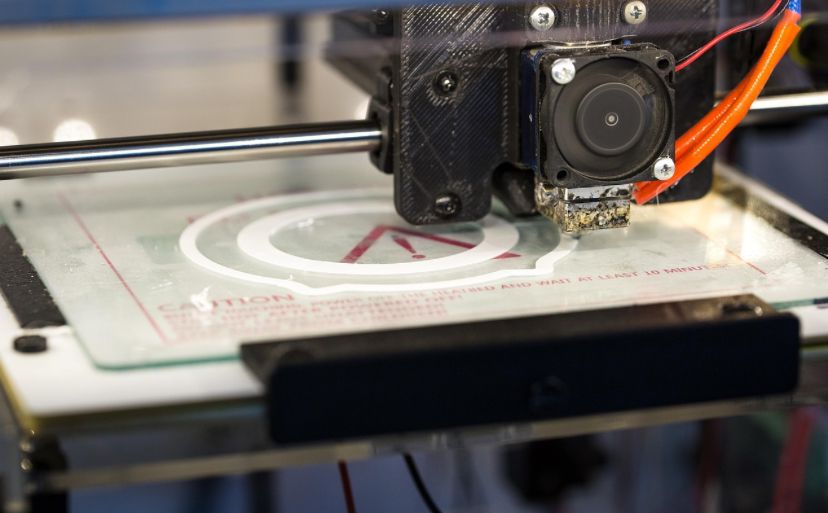

AML3D’s ARCEMY® X system utilises its proprietary WAM® (Wire Additive Manufacturing) process, an advanced form of metal 3D printing that combines welding science, robotics automation, and materials engineering. The technology offers:

These characteristics are particularly attractive for mission-critical sectors such as defence, aerospace, nuclear energy, and utilities, where reliability, localised production, and material performance are paramount.

As of 11:49 AM AEST on Monday, August 4, 2025, AML3D shares were trading at $0.26, down 1.89% on the day, with over 2.5 million shares changing hands. Despite the minor dip, the stock is still up 62.5% year-to-date, reflecting growing investor confidence in the company’s global expansion efforts and its deepening U.S. presence.

With over 545.94 million shares on issue and a market capitalisation of $141.94 million, AML3D is now positioned as a key player in the global industrial additive manufacturing landscape.

AML3D’s breakthrough into the U.S. utilities sector, through a high-profile contract with TVA, showcases not only its technological edge but also its evolving business strategy. With a strong foothold in defence and now energy, the path is being paved for the company to diversify into other critical sectors.

This isn’t just a contract win—it’s a statement that AML3D’s industrial-grade 3D printing systems are finding their place at the heart of America’s infrastructure and innovation priorities.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles