Australia’s equity market remained largely flat on Wednesday despite a wave of supportive macroeconomic data and a global rally fueled by geopolitical de-escalation. The S&P/ASX 200 hovered near 8,551.7 in mid-session trade, with mixed sectoral performance and investors awaiting clearer cues from the Reserve Bank of Australia.

The standout development was the Australian Bureau of Statistics’ latest CPI readout for May, which showed headline inflation slowed to 2.1%—the lowest annual increase since October 2024 and well below market forecasts of 2.3%. The trimmed mean CPI, a preferred core measure, eased to 2.4%, marking its lowest point since November 2021.

Rents climbed 4.5%—the slowest pace since December 2022—while food inflation moderated to 2.9%. Analysts said these trends point toward slackening consumer demand and offer the RBA a green light for monetary easing.

“There’s now a very real case for a July rate cut,” said independent economist Sharman Chan. “We’re firmly within the 2–3% inflation target. While some rebound risks remain, the overall trajectory justifies easing.”

Markets are now pricing in a 90% probability of a July rate cut, with cash rate futures suggesting a 0.5 percentage point cut is on the table.

Australian consumer price inflation (CPI) fell by more than expected in May as petrol prices dropped and housing costs cooled, while core inflation hit three-and-a-half-year lows in a boost to the case for a near-term interest rate cut. #ausecon #auspol pic.twitter.com/iDMVcUYBcw

— CommSec (@CommSec) June 25, 2025

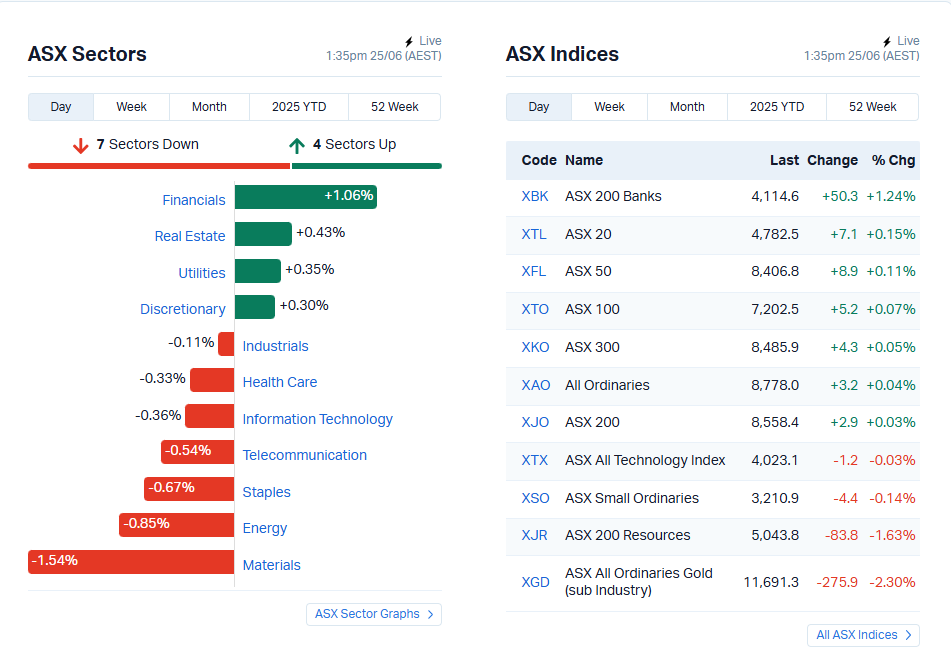

Source: MarketIndex

Sector-wise, Financials (+0.92%) and Utilities (+0.27%) led gains, supported by falling rate expectations. Energy (-1.46%) and Materials (-0.14%) underperformed, tracking lower commodity prices.

Source: MarketIndex

Droneshield (ASX: DRO) soared 21.85% to $2.175 after announcing its largest contract to date.

Collins Foods (ASX: CKF) rallied 11.85% to $9.53 on robust earnings.

SRG Global (ASX: SRG) jumped after securing $850 million in contracts, underscoring strength in civil and defense infrastructure demand.

On the downside, Emerald Resources (ASX: EMR) fell 9.36%, and IGO Ltd (ASX: IGO) shed 5.32%, weighed down by weakening metals sentiment.

U.S. markets extended their rally, with the S&P 500 up 1.11% to 6,092, the Nasdaq climbing 1.43%, and the Dow Jones adding 507 points. The surge was underpinned by confidence in a tenuous ceasefire between Israel and Iran, which investors hope will avert broader conflict in the Middle East.

President Donald Trump declared on Truth Social that “Israel is not going to attack Iran,” signaling a de-escalation after days of high-stakes military tension. Despite a lack of formal agreement—Iranian Foreign Minister Abbas Araqchi clarified that no official ceasefire has been signed—the market has reacted positively to signs of restraint.

IAEA Director General Rafael Grossi said on Tuesday that he had contacted Iran’s Foreign Minister Abbas Araqchi to propose a meeting and urged renewed cooperation in the wake of the Iran-Israel ceasefire.

IAEA Director General Rafael Grossi said on Tuesday he had reached out to Iran’s Foreign Minister Abbas Araqchi to propose a meeting and called for renewed cooperation following the ceasefire between Iran and Israel

— Middle East Eye (@MiddleEastEye) June 24, 2025

More here ⤵️ https://t.co/JH1YVzhIXv

Brent crude fell 6.1% to $67.91/bbl

WTI dropped 6% to $65.20/bbl

This provided a tailwind to airline and logistics stocks globally and may offer downstream relief to fuel-sensitive sectors in Australia.

“The market is shifting focus from military risk to macro fundamentals,” said Jon Brager of Palmer Square Capital. “With inflation cooling and policy pivots looming, risk-on sentiment is resurfacing.”

Federal Reserve Chair Jerome Powell dampened expectations of a July U.S. rate cut, saying the Fed would monitor the impact of tariff adjustments before making a move. Nevertheless, Australia’s data-dependent RBA may diverge given the stronger case locally.

“The trimmed mean now sits under the mid-point of the RBA’s inflation target,” noted David Taylor, ABC’s business reporter. “Not acting soon risks over-tightening and unnecessary employment pain.”

With monthly CPI readings now consistently below forecast, several economists expect NAB’s Sally Auld’s July cut prediction to become consensus.

The ASX’s modest dip today belies the underlying optimism pervading markets. Inflation cooling faster than expected and geopolitical tensions easing offer room for central banks to support growth. Barring unforeseen shocks, July may usher in a policy pivot—possibly even before the Fed.

As of 1:16 pm AEST, the ASX 200 stood at 8,551.7, down 0.04%. The Australian dollar was trading at 0.6502 USD.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles