Friday, July 11, 2025 — SYDNEY

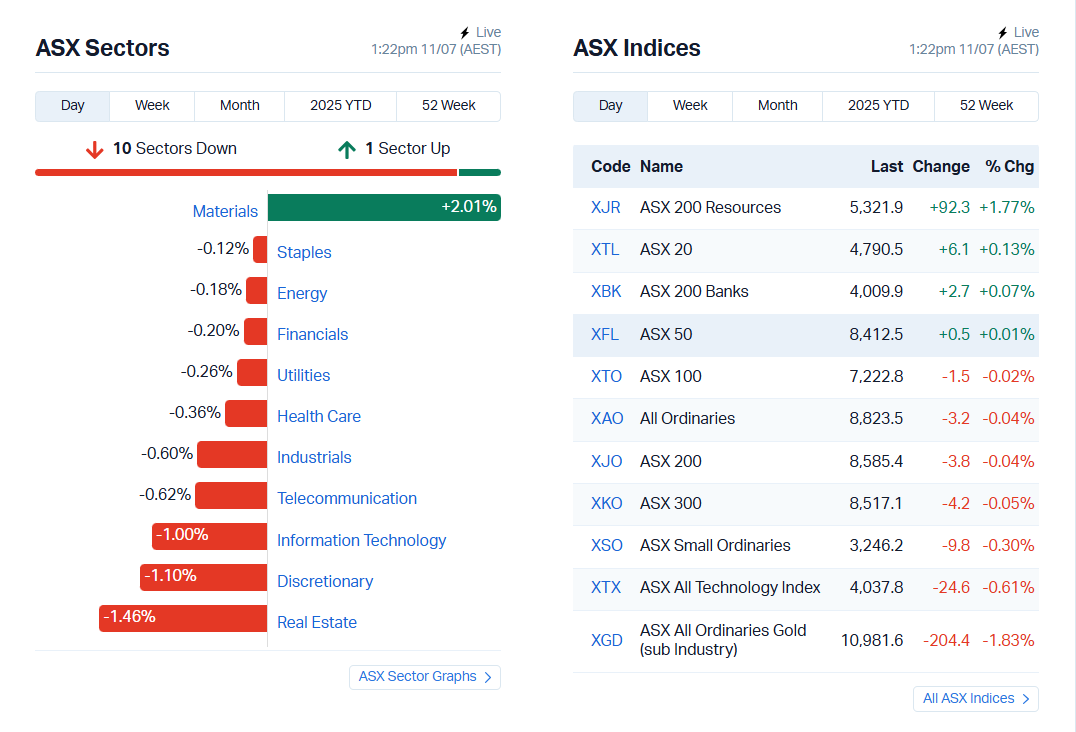

Australia’s benchmark ASX 200 index is treading water today, shedding 3.8 points (-0.04%) to trade at 8,585.4 in early afternoon trade, as global markets reel from a fresh round of tariff warnings by U.S. President Donald Trump. The All Ordinaries Index also dipped 0.04% to 8,823.5, while the All Technology Index saw a sharper pullback of 0.61%.

The Australian dollar dropped 0.3% to 65.66 US cents, reflecting a defensive investor mood. Market participants digested a flurry of geopolitical developments as commodity-linked sectors buoyed the bourse against broader risk-off sentiment.

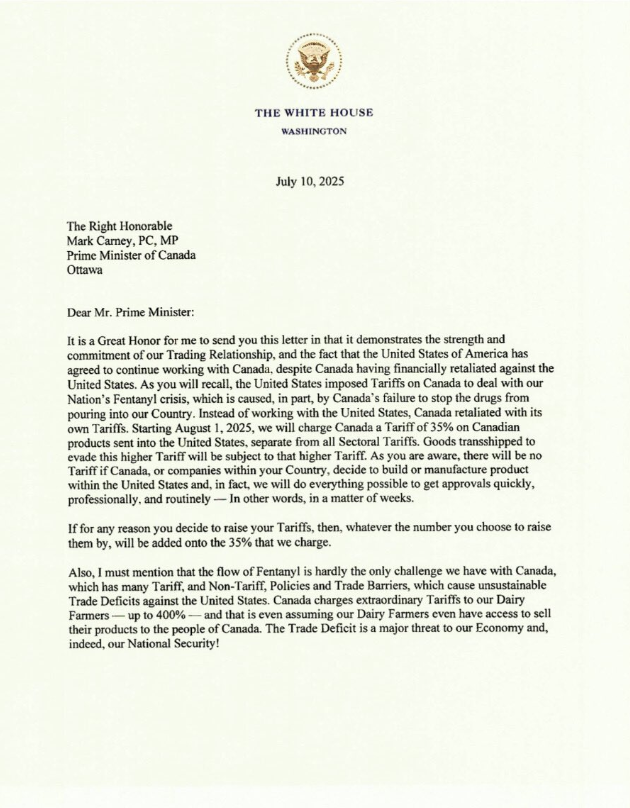

Donald Trump jolted markets overnight by announcing a sweeping 35% tariff on a range of Canadian imports, effective August 1. The U.S. president, citing ongoing fentanyl smuggling and broader trade imbalances, said in a letter to Canadian PM Mark Carney:

“Fentanyl is hardly the only challenge we have with Canada, which has many Tariff, Non-Tariff, Policies and Trade Barriers, which cause unsustainable Trade Deficits against the United States.”

According to a Bloomberg report, while energy-related imports may retain lower tariffs of around 10%, most non-trade deal items will now be levied at the higher rate. The announcement follows similar threats toward Brazil and signals a broad escalation in U.S. protectionism.

In an exclusive interview with NBC, Trump mentioned that blanket tariffs of 15–20% may soon apply to “most trading partners,” raising alarm bells in global supply chains. After continued persistance from Washington on various tariff brackets, its becoming clear that tariffs have been cemented as a core part of US Government strategy to deal with its trading partners.

Interestingly, the Productivity Commission suggested earlier this week that Australia could actually benefit modestly from these tariff disruptions. Alex Robson, deputy chair of the commission, noted:

“There’s capital outflow from the United States that’s got to go somewhere. It comes to Australia as well as other countries … [and] is actually good for GDP in Australia, by a very small amount.”

Rabobank’s Ben Picton also flagged that Australia, unlike Brazil, may avoid harsh U.S. scrutiny — unless its alignment with China deepens.

Don’t discount the possibility of Australia facing a higher tariff rate than 10%. We’ve recently annoyed the Americans on defence spending, Israel sanctions, free speech (eSafety Commissioner) and non-tariff barriers for US tech (news media bargaining code). https://t.co/0zDCO6wMis

— Benjamin Picton (@BenPicton1) July 11, 2025

Despite trade friction, the ASX’s Materials sector roared ahead by 2.01%, lifted by overnight news that the U.S. Defense Department would invest US$400 million in rare earths miner MP Materials.

This move triggered a major rally across Australian critical minerals stocks:

“Investor sentiment is incredibly bullish for rare earths right now, especially with the U.S. government putting real capital behind supply chain security,” said Michael Janda, ABC’s senior finance correspondent.

On the flip side, Information Technology (-1.10%) and Consumer Discretionary (-1.46%) dragged on overall gains. Real estate and healthcare also dipped more than 0.5% as investors took profits amid rising macro uncertainty.

Notable decliners included:

Vulcan Energy Resources (-10.75%)

Ora Banda Mining (-9.31%)

Botanix Pharmaceuticals (-6.06%)

Imricor Medical Systems (-4.17%)

Despite Trump’s tariff barrage, Wall Street indices surged to record highs overnight:

AI-driven gains and copper speculation helped offset broader concerns. Nvidia became the first $4 trillion public company, up 0.8% Thursday.

“Markets are desensitized to Trump’s trade maneuvering,” said Mike Dickson of Horizon Investment, adding:

“Valuations are back above January highs. Tariff risks are real, but investors are clearly betting on tech and domestic stimulus.”

Bitcoin is once again gaining bull momentum with other cryptocurrencies also surging, with Bitcoin crossing $113,863.31 for the first time. Altcoins joined the rally, fueled by more than $300 million in liquidated short positions across exchanges, according to CoinGlass.

Source: MarketIndex

Despite the flat finish, volatility remains low with the ASX VIX index holding at 10.8, suggesting short-term calm. However, traders remain on edge about Trump’s August 1 deadline for broad-based tariff enforcement. Despite the recent tariff jolts and geopolitical tension, the ASX has kept its composure.

Looking ahead, all eyes are on CPI data due later this month, which will shape the RBA’s next move. Capital Economics now sees Australia’s interest rate trough in Q2 2026 at 2.85%.

ASX 200: 8,585.4 (-0.04%)

AUD/USD: 0.6579

Brent Crude: $68.84/bbl

Gold: $3,334.68/oz

Bitcoin: $115,631

Iluka Resources: $4.75

Lynas Rare Earths: $9.80

Nvidia: above $4 trillion market cap

S&P 500: 6,280.46

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles