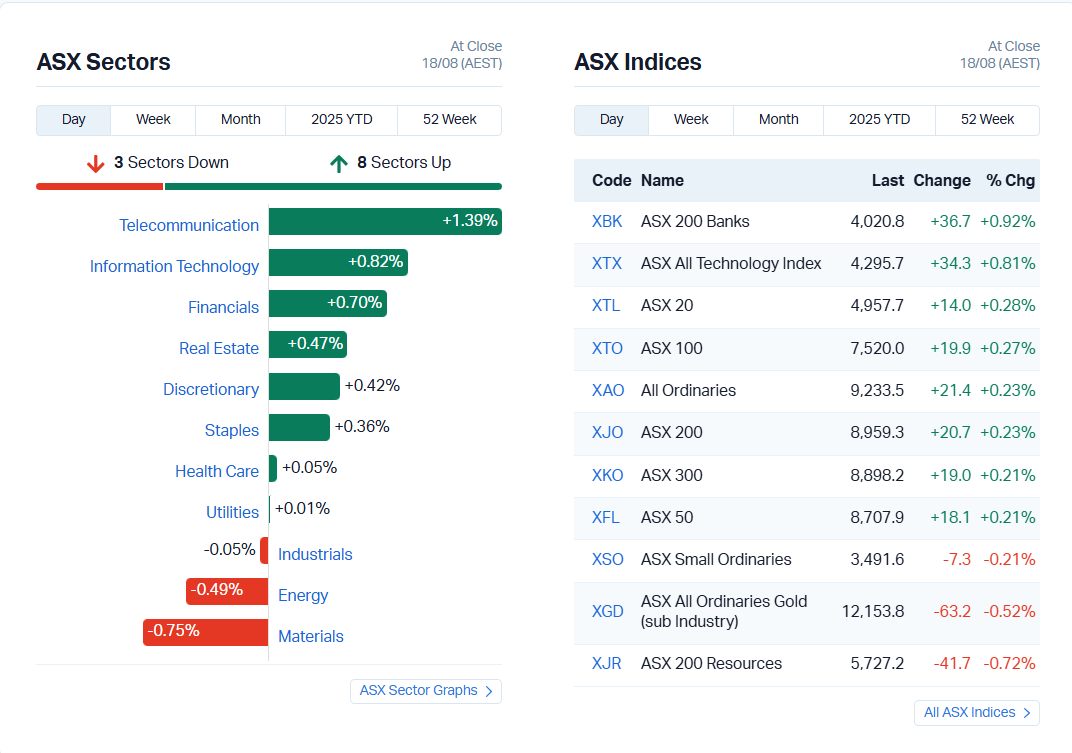

The Australian sharemarket delivered a mixed performance on Monday, 18 August 2025, with the ASX 200 edging 20.7 points higher to close at 8,959.3, a modest 0.23% gain. The broader All Ordinaries finished at 9,233.5 while the All Technology Index surged 0.81% to 4,295.7, reflecting renewed investor appetite for growth stocks.

Trading sentiment was tempered by headline corporate events, including Qantas’ record $90 million penalty, a widening NAB payroll scandal, and the ACCC’s $55 million fine on Google. Meanwhile, resource stocks struggled as commodity prices softened, dragging down the heavyweight mining sector.

Source: MarketIndex

The most striking development came from the Federal Court’s ruling against Qantas (ASX: QAN), which fined the airline $90 million for illegally outsourcing 1,800 ground staff during the COVID-19 pandemic.

Qantas CEO Vanessa Hudson admitted the penalty was justified:

“We sincerely apologise to each and every one of the 1,820 ground handling employees and to their families who suffered as a result. The decision to outsource during such an uncertain time caused genuine hardship. Over the past 18 months we’ve worked hard to rebuild trust with our people and customers. This remains our highest priority.”

The airline has also committed $120 million in compensation via a fund administered by Maurice Blackburn. Analysts suggest while the financial hit is manageable for Qantas’ balance sheet, the reputational damage could linger, especially as the carrier battles to restore trust among staff and passengers.

National Australia Bank (ASX: NAB) revealed further underpayments, estimating a $130 million financial hit as payroll remediation costs spiral. CEO Andrew Irvine acknowledged the bank’s failures:

“The costs of rectifying payroll issues are disappointing, but this must be fixed. Paying our colleagues correctly is an absolute priority.”

The Finance Sector Union (FSU) condemned the issue as “systemic wage theft,” noting NAB has now provisioned nearly $400 million over five years to address staff underpayments. Despite the controversy, NAB shares rose 1.6% as investors looked past short-term costs and focused on resilient core earnings.

The ACCC fined Google $55 million for anti-competitive conduct involving pre-installation deals with Telstra and Optus, which locked Google Search onto Android phones between 2019 and 2021.

ACCC Chair Gina Cass-Gottlieb emphasised the wider significance:

“We go into the future from now with real choice for consumers. The benefits that will bring for competition are of huge significance.”

While Google accepted the penalty, critics argue such fines remain immaterial for a tech giant with global revenues exceeding US$300 billion. Still, the ruling strengthens the ACCC’s broader Digital Platforms inquiry and signals growing regulatory scrutiny of Big Tech in Australia.

Sector rotation dominated trading, with eight of 11 sectors closing higher.

Gainers: Telecommunications (+1.39%), IT (+0.82%), Financials (+0.70%)

Laggards: Energy (-0.75%), Materials (-0.49%), Industrials (-0.05%)

Healthcare stocks led the charge:

By contrast, miners weighed on the index:

BHP (ASX: BHP), Rio Tinto (ASX: RIO), Fortescue (ASX: FMG) all fell 1–1.5% amid weaker iron ore prices at US$102/tonne.

Whitehaven Coal (ASX: WHC) dropped 3% as energy sentiment soured.

Overseas, Wall Street futures pointed to a firmer open, with S&P 500 futures up 0.2%. European equities were flat on Friday, while Asian markets showed strength, led by Japan’s Nikkei 225 (+0.9%).

In commodities, Brent crude closed slightly higher at US$65.89/barrel, while gold rose 0.4% to US$3,349/ounce, signalling continued safe-haven demand. The Australian dollar firmed to US$0.6521, supported by global risk appetite.

Attention now shifts to BHP, CSL, and Woodside, all set to release results on Tuesday. Analysts expect:

BHP: Net profit down 25% to US$10.2b as iron ore weakens

Woodside: Profit dropping to US$2.1b with dividend cuts

CSL: Net profit above US$3b, with R&D spend reaffirmed

UBS warned CSL’s US exposure could face a 5–22% hit if US “most favoured nation” drug pricing reforms materialise.

Despite Monday’s flat session, the ASX 200 remains near record highs, with volatility at subdued levels. The VIX index closed at 10.7, suggesting low investor fear and steady confidence over the next 30 days.

While the Qantas penalty and NAB’s payroll scandal grabbed headlines, markets appear to be absorbing shocks with resilience. The real test lies ahead in reporting season, as investors weigh corporate earnings against a slowing global economy.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles