Australian shares found their footing on Thursday, January 22, 2026, with the S&P/ASX 200 up about 0.6% to 8,835 and the All Ordinaries up 0.6%. The lift was broad enough to feel like a reset after a choppy week, but the real story was not a sudden burst of optimism. It was a rotation.

Money flowed back into rate sensitive sectors like banks and discretionary, while the market quietly trimmed its most crowded safety trade of the month: gold.

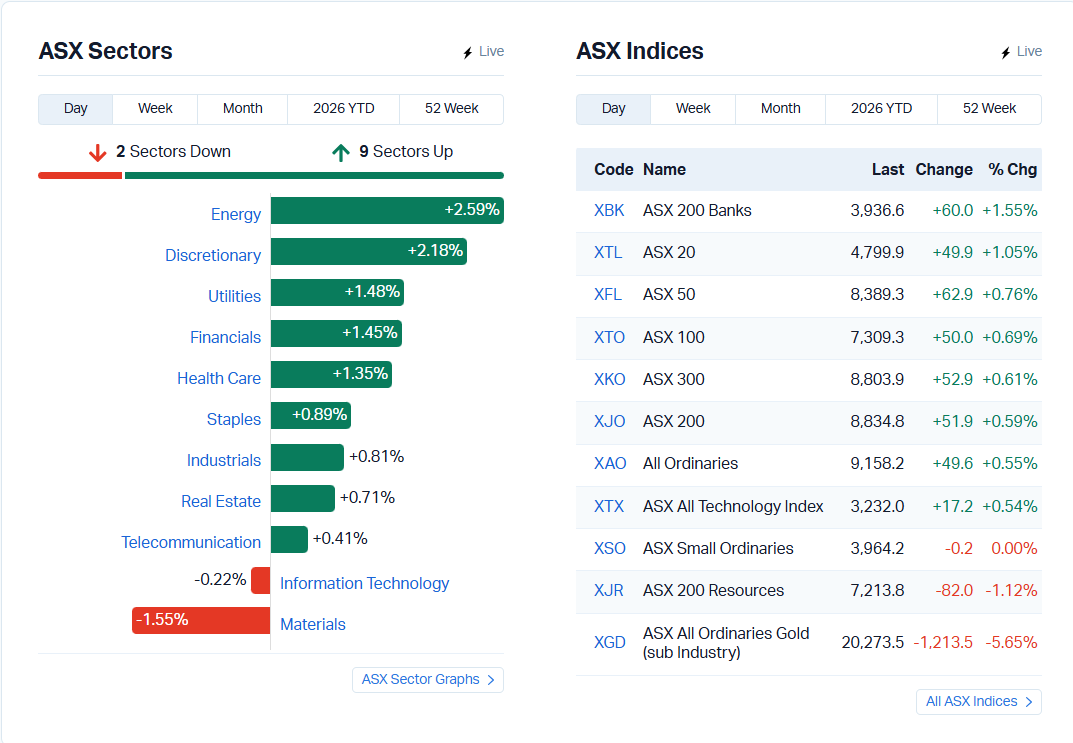

That push and pull was visible in the sector tape. Energy led with a 2.6% to 2.7% gain, consumer discretionary jumped about 2.2%, and financials rose around 1.5%. At the other end, materials slipped and the gold sub index fell sharply, after bullion gave back some of its recent surge.

Source: MarketIndex

The biggest macro signal arrived from the labour market, and it landed with a thud.

Australia’s unemployment rate fell from 4.3% to 4.1% in December, while employment increased by 65,000, driven mostly by full time gains. The participation rate lifted to 66.7%.

The market’s immediate response was visible in pricing for the next Reserve Bank decision: money markets lifted the implied chance of a February rate hike to about 53%, from 29% previously, following the jobs print.

Economists were quick to caution against over reading a single month, but the tone shifted.

KPMG chief economist Brendan Rynne called the jobs number stronger than expected: “The creation of more than 65,000 new jobs last month shows a much stronger labour market than any of us anticipated,” he said. At the same time, he argued it does not automatically force the RBA’s hand: “These figures, while better than expected, will not come as a huge surprise to the RBA. It is well aware that it is inflation not the labour market that is the ongoing issue driving interest rate uncertainty.”

Betashares chief economist David Bassanese pointed the spotlight to next week’s inflation data, calling it the real pivot point for the near term path of rates, describing the December quarter CPI as a “make or break” moment for mortgage holders.

There was also a dissenting view in the mix. Deloitte Access Economics again flagged a more patient RBA path, saying it expects no hikes and instead a hold into a potential rate cut later in the year, with its analysts pointing to an economy they describe as still “nascent”.

The point for markets is simple: the ASX can rally, but it is now doing so while the rate path is being repriced in real time.

That repricing helped explain the market’s winners.

Banks climbed about 1.6%, with the big four up between roughly 0.7% and 2.7% in afternoon trade. For the broader market, it was a reminder of how quickly sentiment flips when the same rates story can be read two ways: higher rates can be a headwind for growth names, but often support bank margins and bring value back into focus.

Consumer discretionary rose about 2.3%, and real estate gained around 0.7%. That is the sort of price action that often shows up when the market believes rates are near a peak, or at least that the next move is not a long hiking cycle. It is not a verdict, but it is a signal.

The clearest momentum was in energy, up around 2.7% and reaching its strongest level since early December.

Two names did much of the heavy lifting.

Santos jumped about 5% after forecasting higher output in 2026.

Woodside added around 3.1%, with traders looking ahead to its own production update due next week.

Oil itself was steady to slightly higher. Brent traded around US$65.33 a barrel and WTI around US$60.77, both modestly up on the session. The backdrop is not a breakout, but it is supportive enough for energy equities that were already showing relative strength.

The day’s sharpest reversal came in the gold complex.

Gold prices remained high but eased from recent records, with spot gold indicated around US$4,792 to US$4,807 an ounce in the updates provided. That was enough to trigger heavy selling in gold miners, which had been standout performers when geopolitics and currency volatility pushed safe haven demand higher.

By afternoon, the gold sub industry index was down more than 5%, on track for one of its worst sessions since mid November.

The market had a clear catalyst in Northern Star, which fell about 8.8% after reporting a sequential decline in quarterly gold sales. In simple terms, when gold equities are priced for perfection, operational stumbles matter more.

The biggest laggards list reflected that tone, with multiple gold names and precious metals linked stocks under pressure. Among the day’s notable fallers in the broader list were Pantoro Gold (-10.8%), Southern Palladium (-10.5%), Vault Minerals (-9.3%), and Northern Star (-8.5%).

The session had two different markets running at once: a risk on bounce in rate sensitives, and a sharp unwind in gold.

Top gainers (selected)

Echoiq (EIQ) +16.7%

Weebit Nano (WBT) +12.9%

Prospect Resources (PSC) +10.8%

Premier Investments (PMV) +9.4%

Appen (APX) +8.4%

DroneShield (DRO) +6.7%

Mesoblast (MSB) +5.6%

Biggest fallers (selected)

Pantoro Gold (PNR) -10.8%

Southern Palladium (SPD) -10.5%

Vault Minerals (VAU) -9.3%

Saturn Metals (STN) -8.9%

Northern Star (NST) -8.5%

Regis Resources (RRL) -8.2%

Emerald Resources (EMR) -7.7%

Overnight, the offshore tone was constructive.

At the close on January 21, the S&P 500 rose 1.16%, the Nasdaq gained 1.18%, and the Dow climbed 1.21%. Asia was mixed, with the Hang Seng up 0.37%, the Shanghai Composite slightly higher, and Japan’s Nikkei lower.

Locally, the live updates also noted that Wall Street ended higher after US President Donald Trump withdrew a threat to impose new tariffs on European nations, a detail that helped take a little heat out of global risk sentiment.

Three themes stood out in Thursday’s trade.

Rates are back in the driver’s seat. The labour market surprise pushed up near term hike odds, but commentary from economists also kept the focus on inflation as the final arbiter. Next week’s CPI print is now the market’s main event.

Rotation is real. Banks and discretionary outperformed while gold cooled and materials lagged. That is not a statement about the end of the gold story, but it is a reminder that crowded trades unwind quickly.

Energy has regained momentum. With Santos’ guidance and oil steady, energy’s leadership looked less like a one off bounce and more like a sector reclaiming attention.

If Thursday felt calmer, it was partly because it had a clean narrative. Strong jobs, shifting rate odds, banks up, gold down, energy up. The bigger test arrives next week when inflation data forces markets to decide whether this bounce is a pause in volatility or the start of a new rhythm.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles