(1).webp)

Australian shares edged lower on Monday, weighed down by losses in the heavyweight banking and energy sectors, as investors digested a flurry of earnings reports and global macro signals.

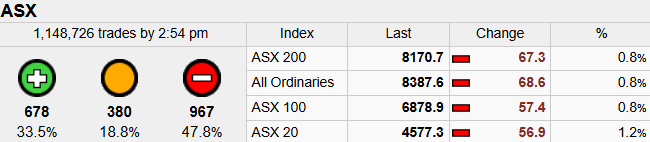

The benchmark S&P/ASX 200 slipped 0.84% to close at 8,169.2, retreating from Friday’s gains. Broader indices followed suit, with the All Ordinaries falling 0.82% and the ASX 300 shedding 0.84%. The sharpest drag came from Financials and Energy, while select gold and healthcare names offered some reprieve.

The market decline came despite a strong finish on Wall Street, where the S&P 500 rose 1.5% on Friday, buoyed by robust U.S. jobs data and signs of potential thawing in U.S.-China trade relations.

ASX Indices - Source: StocknessMonster - 5th May 2025

Banking stocks were under heavy pressure following a disappointing first-half earnings result from Westpac, which missed consensus estimates and flagged cautious forward guidance. The ASX 200 Banks Index dropped 1.93%, with investors questioning the sustainability of net interest margins amid slowing loan growth.

Energy stocks also slid as Brent crude tumbled 3.62% to $59.07 a barrel, while WTI crude sank nearly 4%. Shares of Woodside Energy and Santos fell in tandem, dragging the broader Energy sector down 2.8%—the worst-performing group of the session.

The All Technology Index lost a modest 0.55%, a sign of relative resilience considering the broader market weakness. Gains from Wall Street’s tech majors—spurred by earnings from Microsoft and Meta—provided some tailwind to local sentiment in the tech space.

Meanwhile, gold miners outshone the broader market as investors turned to safe-haven assets amid lingering global uncertainties. The ASX All Ordinaries Gold Index rose 0.82%, supported by a 0.68% lift in gold prices to $3,265.30/oz. Notably, Gold Road Resources surged 9.76%, while Syrah Resources rallied 16.33%, topping the list of gainers.

Syrah Resources Ltd (SYR): +16.33% to $0.285

Immutep Ltd (IMM): +10.19% to $0.2975

Gold Road Resources Ltd (GOR): +9.76% to $3.26

Tyro Payments Ltd (TYR): +8.71% to $0.8425

Peet Ltd (PPC): +7.88% to $1.575

Brainchip Holdings Ltd (BRN): -9.80% to $0.23

Navigator Global Investments Ltd (NGI): -6.67% to $1.54

Metals X Ltd (MLX): -6.64% to $0.5275

Stanmore Resources Ltd (SMR): -6.07% to $1.935

Chrysos Corporation Ltd (C79): -6.04% to $3.89

Out of 11 sectors, only Industrials (+0.35%), Healthcare (+0.14%), and Utilities (+0.02%) closed in the green. Real Estate (-0.94%) and Consumer Discretionary (-0.70%) also weighed, reflecting investor caution around interest rate-sensitive and cyclical segments.

Top gainers in the session included Immutep (+10.19%), Tyro Payments (+8.71%), and Mercury NZ (+5.76%). On the flip side, Brainchip Holdings plummeted 9.8% and Navigator Global Investments lost 6.67%, leading the laggards.

The Australian dollar firmed slightly to US$0.6463, helped by stronger-than-expected Chinese services data and a mild pullback in the U.S. dollar. In commodities, copper ticked higher by 0.37% to $4.64/lb, offering some support to materials stocks.

Investors will now turn their focus to Tuesday’s RBA meeting, with expectations centered on a hold. However, the language around inflation trajectory and labor market softness could sway sentiment. Globally, markets await more clues from the Federal Reserve and incoming data from the U.S. labor market and China’s trade balance.

Despite Monday’s pullback, analysts say near-term volatility is likely to remain subdued, with the ASX VIX Index at a low reading of 12.6, suggesting strong investor confidence.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles