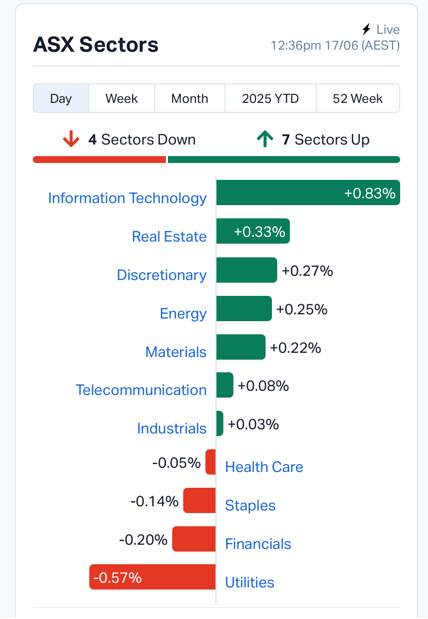

Australian equities saw subdued gains on Tuesday, as the S&P/ASX 200 nudged 0.04% higher to close at 8,551.8. The broader All Ordinaries added 0.10% to 8,783.4, while the Small Ordinaries outperformed with a 0.74% rally—buoyed by a surge in uranium and gold names.

The cautious advance came despite strong overnight gains on Wall Street and rising geopolitical tensions in the Middle East. Investor sentiment remains tethered to central bank signals and volatile energy markets, with the ASX showing resilience amid a complex global backdrop.

Source: MarketIndex | Source Link: https://www.marketindex.com.au

US indices surged overnight, led by the Nasdaq (+1.52%) and S&P 500 (+0.94%) as investors piled into tech stocks. Meanwhile, speculation is growing that the US Federal Reserve could announce a July rate cut as early as this week’s FOMC meeting—especially in light of mounting global risk tied to renewed US-Iran tensions.

The Dow Jones Industrial Average gained 317 points to close at 42,515.09. Market watchers noted that the equity drawdown model, per Goldman Sachs Research, remains elevated—but dovish central bank pivots could cushion any sharp pullbacks.

Uranium was the standout story on the ASX, with Bannerman Energy (ASX: BMN) rocketing 13.85%, Deep Yellow (ASX: DYL) up 9.87%, and Boss Energy (ASX: BOE) rising 6.24%. The rally follows tightening global uranium supply and rising demand expectations tied to energy security.

Other top performers included SILEX Systems (ASX: SLX) and Bellevue Gold (ASX: BGL), reflecting a broader risk-on tone across critical and green energy metals.

Source: MarketIndex | Source Link: https://www.marketindex.com.au

The ASX VIX remains low at 11.6, indicating investor confidence—though underlying risks remain. Brent crude rose 0.78% to $74.03 as conflict between Israel and Iran threatens to disrupt supply via the Strait of Hormuz. Gold held steady at $3,394/oz, while copper dipped slightly.

The Australian dollar hovered at 0.6521 USD.

Investor focus is turning to upcoming IPOs, with Greatland Resources (GGP) and Virgin Australia Holdings (VGN) set to list on June 24. Meanwhile, dividend activity remains active, with Fisher & Paykel, Centuria, and Rural Funds all scheduled to pay out before month-end.

The FOMC meeting later this week will be pivotal. Analysts at IG suggest a 25bps rate cut in July is now plausible, especially if Middle East tensions intensify. Markets are currently pricing only a 12.5% chance—but that could rise rapidly.

If dovish tones prevail, global equities may rally further—though Australian investors remain cautious, balancing optimism with geopolitical and macroeconomic headwinds.

The ASX continues to navigate a complex web of global signals—resilient yet cautious. With tech stocks rising, uranium miners surging, and the Fed poised for a potential pivot, investors should brace for volatility and opportunity in equal measure.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles