Power Long-Term Growth.png)

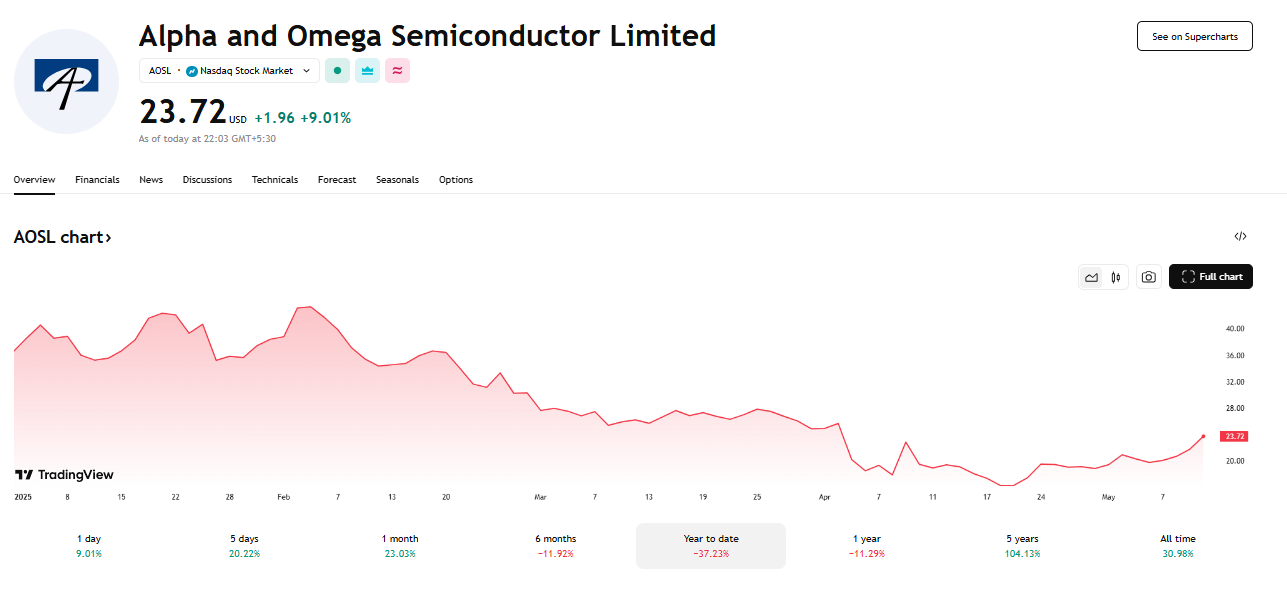

While many semiconductor stocks ride macroeconomic tailwinds in waves, Alpha and Omega Semiconductor Limited (NASDAQ: AOSL) may quietly be positioning itself as a long-term growth contender within the power management landscape. The stock surged over 9% to $23.82 in Monday’s session, fueled by better-than-expected third-quarter earnings and forward-looking optimism from management.

Despite modest topline forecasts, AOSL's strategic foothold in power semiconductors—critical for computing, industrial, and battery-powered devices—could anchor the company amid sector cyclicality and position it for durable growth as electrification and efficiency demand scale globally.

In its Q3 FY2025 results (ended March 31), AOSL reported $164.6 million in revenue, up 9.7% year-over-year, though slightly down from the previous quarter. Non-GAAP gross margin came in at 22.5%, a decline from the previous quarter’s 24.2%, reflecting some margin compression amid a broader tech sector slowdown.

The company posted a GAAP net loss of $10.8 million or $0.37 per diluted share, while non-GAAP losses narrowed to $0.10 per share. Although the figures reveal ongoing operational challenges, they were notably better than analysts expected, with a revenue beat of nearly 5%.

CEO Stephen Chang emphasized the company’s double-digit growth in the computing and industrial verticals, noting demand strength in tablets and PC components. "Our strategy to become a total solutions provider is showing traction,” Chang said, adding that AOSL is expanding its bill-of-materials (BOM) content across high-growth applications.

While analysts remain cautious—some trimming price targets to $28.33 amid rising per-share losses—the core story remains compelling. AOSL continues to develop complex, high-performance power solutions for Tier 1 customers in computing, energy, and consumer electronics, positioning it at the heart of long-duration tech trends such as:

Even as sector peers forecast 16% revenue growth annually, AOSL's estimated 3.1% CAGR may seem underwhelming. Yet this discrepancy may reflect temporary margin volatility and R&D investment, not structural weakness.

Moreover, AOSL’s $169.4 million cash reserve, positive operating cash flow, and capital-light business model offer balance-sheet durability rarely seen in similarly sized chipmakers.

Technology and semiconductor stocks globally rallied Monday after the U.S. and China agreed to pause most tariffs on each other’s goods. The de-escalation gave markets a welcome reprieve, especially as tech firms across the semiconductor supply chain had been under pressure from protracted trade tensions.

In the U.S., Nvidia rose 4%, AMD gained nearly 6%, and Broadcom and Qualcomm added roughly 5%. Even Marvell Technology, which postponed a recent investor day due to macroeconomic uncertainty, climbed 7%.

International names followed suit: ASML in Europe jumped 4%, Infineon surged, and TSMC’s U.S.-listed shares advanced 6%. Meanwhile, U.S.-listed Chinese tech giants like Alibaba and JD.com also moved sharply higher.

The coordinated market rally lifted sentiment across the board, offering a tailwind for mid-cap names like Alpha and Omega Semiconductor, which had been navigating margin pressures and mixed analyst expectations.

AOSL Year-to-Date Price Chart - Source: TradingView

Certainly, risks remain. The stock has experienced wide valuation swings, trading between $15.90 and $53.29 over the past 52 weeks. Margins have tightened, and the company is yet to return to consistent profitability. But for investors looking beyond near-term earnings and toward technology enablement across edge devices, data centers, and clean tech, AOSL represents a differentiated player with a growing IP moat.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles