.webp)

Global trade is undergoing a seismic shift as unprecedented tariff hikes under President Donald Trump's administration reshape supply chains and force businesses worldwide to rethink their strategies. Goldman Sachs' latest insights highlight how the current wave of tariffs, now exceeding even the first Trump administration's trade confrontations from 2018, is causing profound disruptions in transpacific commerce.

According to Goldman Sachs analyst Patrick Creuset, US retailers anticipate a dramatic 20-30% drop in imports over the coming months, signaling a sharp contraction in shipments between Asia and the US. The ripple effects could extend deep into supply chains, prompting businesses to engage in aggressive inventory destocking. While imports initially surged early in the year as businesses stocked up ahead of anticipated tariff hikes, the delayed effects are now surfacing, setting the stage for a potentially rocky second half of 2025.

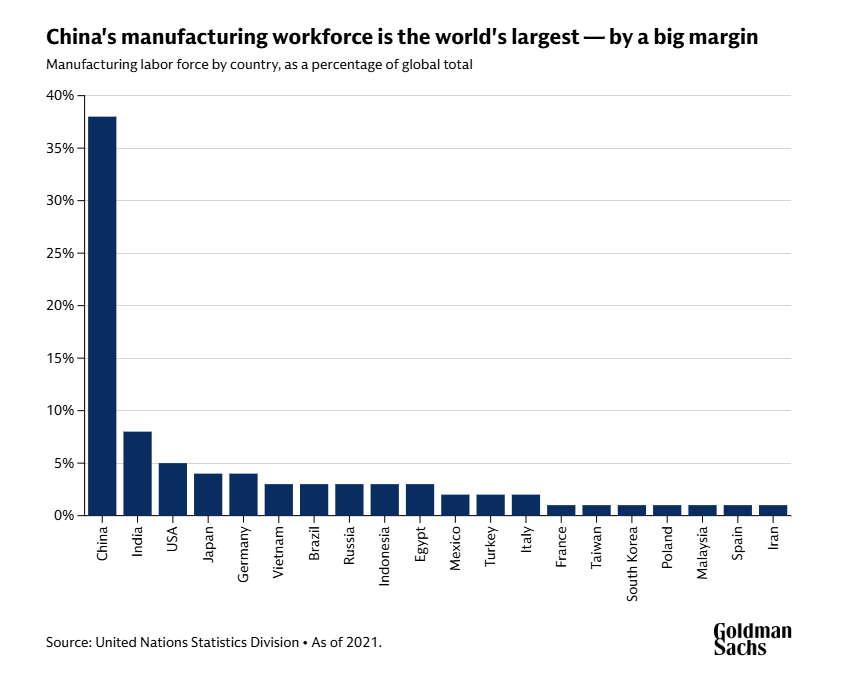

Yet, despite near-term disruption, the fundamental fabric of global trade remains tied to Asian markets, especially China. Goldman Sachs emphasizes that the sheer scale of China's manufacturing capability—five times larger than the combined workforces of the US, Mexico, and Canada—makes the nation virtually irreplaceable in global commerce. Even aggressive reshoring or nearshoring strategies would only marginally reduce dependency on China in the short term.

Manufacturing Workforce Comparision | Source: UN Statistics Division & Goldman Sachs

One of the standout parallels with past tariff episodes, such as during Trump's first term, is the phenomenon of rerouting goods through alternative countries. Nations like Vietnam, Mexico, and other Asian neighbors may increasingly become intermediaries for goods originally manufactured in China. Given the substantial tariff differential between China and these alternate nations, businesses are incentivized to employ roundabout routes, exploiting tariff rules that acknowledge "substantial transformation" occurring in these intermediary countries, thus qualifying for reduced tariffs.

Despite talk of deglobalization, Goldman Sachs' research underscores that the epicenter of international trade remains firmly rooted in Asia. The fastest-growing trade routes continue to originate from Asia, with burgeoning commerce between China and emerging markets in the Global South becoming ever more pronounced.

However, the scale of the current tariff increases has reached heights not seen since the Smoot-Hawley tariffs nearly a century ago, raising the stakes for global economic stability. The imminent contraction in Asia-US trade could rival or even surpass declines seen during major disruptions such as the 2008 financial crisis and the COVID-19 pandemic. If US policymakers decide to tolerate slower growth and elevated inflation to sustain tariffs, the economic repercussions could deepen significantly.

Goldman Sachs also outlines key indicators investors should monitor to gauge the trajectory of the tariff-driven disruption. The US purchasing managers' index (PMI) will serve as a critical early warning indicator, reflecting inventory levels and import demand. Additionally, near-real-time data from Chinese port container volumes can provide immediate insights into evolving trade patterns.

Yet, the path forward remains uncertain. Goldman Sachs highlights two diverging scenarios: a possible easing of tensions, reminiscent of earlier tariff conflicts that ultimately had minimal long-term impact on trade patterns, or a worsening cycle of retaliatory tariffs and geopolitical tension that could dramatically reshape global markets and capital flows.

In the context of financial markets, these uncertainties have already triggered significant volatility. Despite recent market downturns, Goldman Sachs' equity drawdown model suggests the S&P 500 remains vulnerable to further declines. Christian Mueller-Glissmann, Head of Asset Allocation Research at Goldman Sachs, cautions investors to brace for continued turbulence, emphasizing that policy shifts—either from President Trump or the Federal Reserve—could swiftly alter market dynamics.

Investors, therefore, face a complex landscape. While short-term disruptions in global trade are undeniable, the long-term structural reliance on Asian manufacturing, particularly Chinese industry, remains entrenched. As businesses navigate the intricacies of tariffs and rerouting, understanding these evolving dynamics becomes essential for making informed investment and operational decisions.

Ultimately, Goldman Sachs advises vigilance amid the volatility. Whether the current tariff escalation will fundamentally alter the global trade paradigm or merely represent another turbulent chapter in the ongoing story of international commerce hinges critically on policy directions and the broader macroeconomic backdrop in the months ahead.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles