Krakatoa Resources Ltd (ASX: KTA) has commenced drilling at its flagship Zopkhito antimony-gold project in Georgia, marking a pivotal moment for the company’s ambitions in critical minerals and precious metals. The maiden program spans 7,000 to 10,000 metres of diamond drilling and is geared toward converting and expanding the project’s existing foreign mineral resource into a JORC-compliant standard.

The move underscores Krakatoa’s commitment to transforming Zopkhito into a long-term producer of gold and antimony, two commodities vital for global technology, energy transition, and defense supply chains.

One of the primary objectives of the campaign is to bring Zopkhito’s historical foreign resource into alignment with JORC standards. Current figures point to a non-JORC foreign estimate of 815,119 ounces of gold and 26,000 tonnes of antimony.

The JORC upgrade, once achieved, would not only validate the scale of the project but also provide credibility with international investors and potential offtake partners. As CEO, Mark Major commented:

Ahead of drilling, Krakatoa refurbished a 30-man exploration camp that had been inactive for nearly a decade. The company has now mobilised two diamond drill rigs to site, specifically designed to handle Georgia’s complex terrain.

This groundwork positions Krakatoa to deliver results efficiently, with assays expected to start flowing in the coming months.

Image: Drill rig on initial platform at Zopkhito

The drilling comes as the global antimony market is projected to grow from US$2.5 billion in 2024 to US$4.1 billion by 2034, at a CAGR of 5.2%. Demand is being driven by antimony’s use in flame retardants, semiconductors, battery technologies, and defense applications. The U.S. has already classified it as a critical mineral, while tightening Chinese exports have intensified global supply pressures.

Gold, meanwhile, continues to maintain its role as both a safe-haven asset and an industrial metal, with prices hovering around historic highs amid geopolitical and inflationary concerns.

Georgia’s investor-friendly policies provide Krakatoa with a favourable backdrop for development. The country has shown 7.5% GDP growth in 2023, ranks #2 globally for starting a business, and benefits from free trade agreements (FTAs) with major markets including the EU, China, Turkey, and the U.S..

Its location as a bridge between Europe and Asia adds export flexibility, particularly with Black Sea port access for future concentrate shipments.

The timing of Krakatoa’s drilling program comes against a backdrop of heightened interest in critical minerals. China, historically the dominant supplier of antimony, has tightened export controls, leading to price spikes. At the same time, gold’s resilience in volatile global markets makes it an attractive hedge for both institutional and retail investors.

According to industry analysts, this combination makes projects like Zopkhito particularly compelling. “Investors are searching for assets that tick both boxes—precious metals security and critical minerals supply. Zopkhito has the potential to offer both,” one Perth-based analyst noted.

Active drilling at Krakatoa Resources’ Zopkhito project is expected to generate a steady flow of updates over the next three to six months. Key developments may include drill assay results and progress toward a potential JORC-compliant resource.

The project combines gold and antimony mineralisation in a region considered strategically significant, aligning with broader interest in critical minerals.

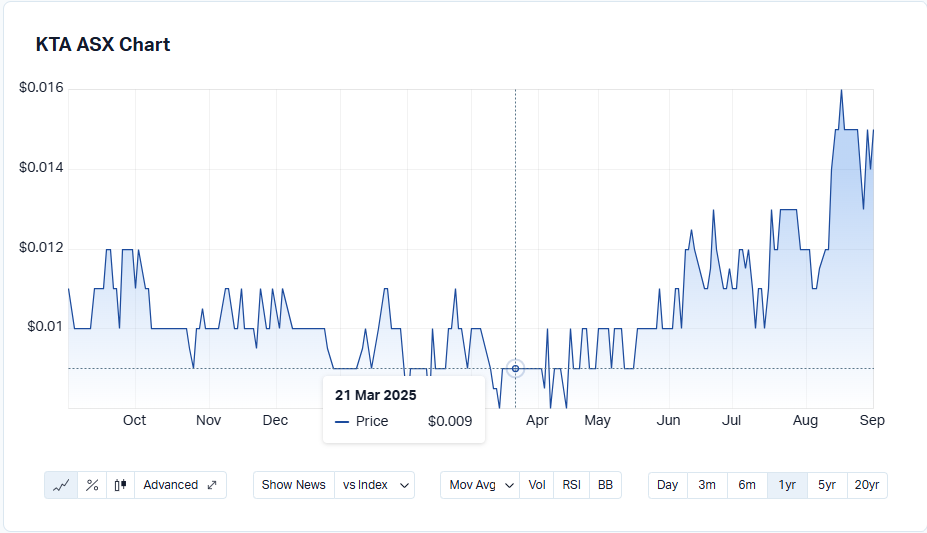

KTA Price Chart: Source- MarketIndex

Krakatoa’s shares reflected investor optimism on Monday, rising 7.14% to $0.015 at midday trading, with volumes surpassing two million shares. The stock has delivered a 36.36% return over the past year and remains up 66.67% year-to-date.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles