Krakatoa Resources (ASX: KTA) has shifted into a decisive operational phase at its highly anticipated Zopkhito Antimony-Gold Project in Georgia, marking a key step toward converting a foreign resource estimate into a JORC-compliant mineral resource. The company’s 16 July 2025 announcement confirms drilling is imminent, with contracts signed, rigs en route, and ground preparations well underway.

This is no ordinary drilling campaign. With a projected program of 7,000–10,000 metres of diamond core drilling, Krakatoa aims to validate and expand on an eye-catching foreign resource estimate: 225Kt @ 11.6% Sb for 26,000 tonnes of contained antimony and 7.1Mt @ 3.7g/t Au for 815,119oz of gold. These are significant figures for a company with a modest market cap of A$8.53 million, and could reshape the valuation outlook if successfully substantiated.

Source: KTA ASX Announcement

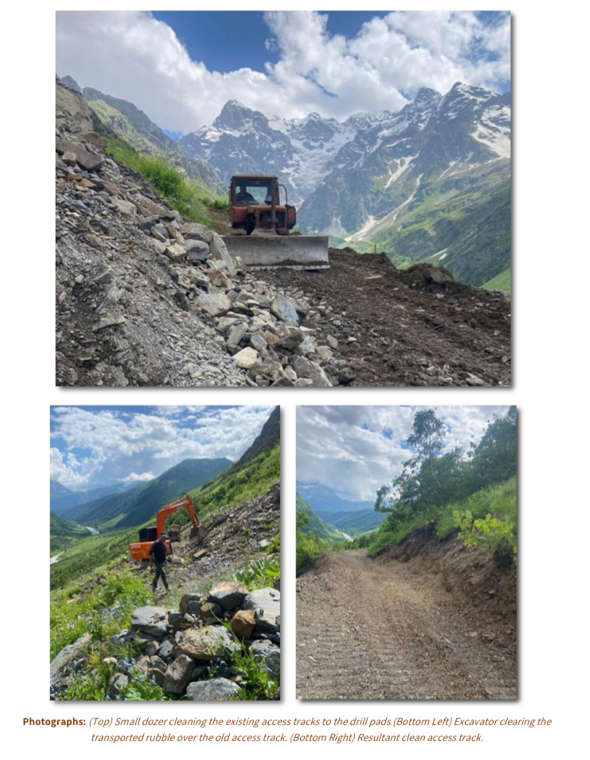

According to the company, a 30-man exploration camp—which had been unused for over a decade—has now been largely refurbished. Key logistical setups, including drill pads and access tracks, are in advanced stages. This transformation was achieved in a matter of weeks, a testament to Krakatoa’s commitment to mobilizing quickly and effectively in an unfamiliar jurisdiction.

CEO Mark Major expressed satisfaction with the operational momentum:

“Drilling contracts have been signed, and the 30-man camp refurbishment is nearing completion. After 10 years of limited use and no maintenance, the camp re-establishment has been rather quick.”

He added:

“We have two drilling companies: one local operator supplying a compact underground-style rig for small-footprint pads and shallower holes, and a second man-portable rig in transit, ideal for steep slopes and narrow platforms.”

Zopkhito, nestled in the northern part of the Racha region of Georgia (~1,779 hectares), represents a unique confluence of geology and logistics. The project area lies 170km from Kutaisi, Georgia’s second-largest city, and is within reach of port infrastructure at Poti and Batumi on the Black Sea—an enviable logistical advantage for future development.

Source: KTA ASX Announcement

The strategic priority for Krakatoa is to convert the foreign estimate into a JORC-compliant resource—a move that would enable economic studies and eventually de-risk the project for downstream funding or JV opportunities. To this end, the company is also planning multiple geophysical surveys to detect extensions of the currently known mineralization.

The current foreign resource is not yet JORC certified, and the company has issued the following caution:

“A competent person has not done sufficient work to classify the foreign estimate as a Mineral Resource in accordance with the JORC Code 2012.”

Antimony (Sb) has emerged as a strategic metal of global significance, used in everything from semiconductors, solar panels, and flame retardants to military-grade materials and pharmaceutical applications. Its critical role in green technology and defense systems has heightened interest in supply stability—especially amid geopolitical shifts.

Krakatoa’s potential to become a significant producer in antimony and gold positions it at a crossroads of commodity relevance and market opportunity.

While Georgia may be an unusual destination for ASX-listed miners, Krakatoa’s choice is backed by a strong macroeconomic story. Georgia ranks:

Its network of free trade agreements—spanning the EU, China, Turkey, the U.S., and Canada—offers duty-free access to 2.8 billion people. For Krakatoa, this could simplify export logistics and enhance project economics, particularly for critical minerals like antimony.

Krakatoa has fired the starting gun on a potentially transformative drilling campaign. While early days, the company’s proactive planning, dual-rig strategy, and focus on two of the world’s most important metals—gold and antimony—could reward shareholders with long-term vision. Investors should watch closely as the Zopkhito story drills deeper, both geologically and strategically.

At the time of writing this article, KTA shares were up by 10%, trading at A $0.011.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles