Key Highlights:

In a landmark move that sent shockwaves through global mining markets, MP Materials (NYSE: MP) surged 51% overnight after announcing a multibillion-dollar partnership with the U.S. Department of Defense (DoD). The pact betweet Pentagon and MP aims to build out a complete domestic rare earth magnet supply chain, insulating America’s tech and defense sectors from China’s dominance in critical minerals.

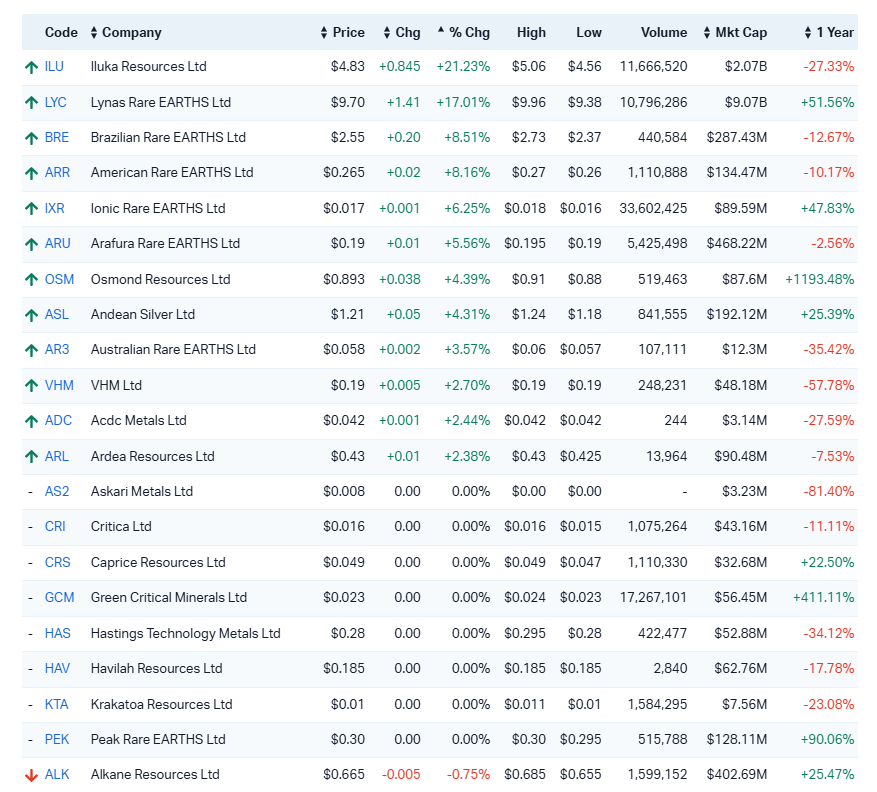

This U.S.-led initiative lit a fire under the Australian rare earths sector on Friday, with ASX-listed majors and juniors rallying strongly by mid-session. Iluka Resources Ltd (ASX: ILU) surged 21.23% to $4.83 and Lynas Rare Earths Ltd (ASX: LYC) jumped 17.01% to $9.70, with both companies benefiting from investor optimism over parallel strategic importance in the U.S. and allied supply chains.

Under the agreement, MP Materials will construct a second magnet manufacturing facility in the U.S., supplementing its existing Texas operation. Notably, the DoD will purchase $400 million worth of preferred MP shares, gaining warrants that could elevate it to MP’s largest shareholder with an estimated 15% stake.

"This initiative marks a decisive action by the Trump administration to accelerate American supply chain independence," said James Litinsky, CEO of MP Materials, in the press release. “We are proud to enter into this transformational public-private partnership and are deeply grateful to President Trump, our partners at the Pentagon, and our stakeholders for their unwavering support.”

This is a win-win-win.

— MP Materials (@MPMaterials) July 10, 2025

A win for $MP stakeholders. A win for the U.S. government. And a win for U.S. taxpayers. pic.twitter.com/lOUABdgwIy

The new facility, dubbed the ‘10X Facility’, is expected to be operational by 2028, boosting MP’s total U.S. magnet capacity to 10,000 metric tons annually. Importantly, the DoD will commit to buying 100% of production for the first 10 years, underpinned by a guaranteed price floor of $110/kg—more than double the current Chinese market rate.

The ASX rare earth sector responded with outsized gains, particularly among developers and juniors perceived to be leveraged to rising Western demand. The top movers included:

| Company | Price | % Change |

|---|---|---|

| Iluka Resources (ILU) | $4.83 | +21.23% |

| Lynas Rare Earths (LYC) | $9.70 | +17.01% |

| Brazilian Rare Earths (BRE) | $2.55 | +8.51% |

| American Rare Earths (ARR) | $0.265 | +8.16% |

| Ionic Rare Earths (IXR) | $0.017 | +6.25% |

| Arafura Rare Earths (ARU) | $0.19 | +5.56% |

Even microcap names such as Australian Rare Earths (ASX: AR3), Osmond Resources (ASX: OSM), and Krakatoa Resources (ASX: KTA) saw increased volume and modest gains (at the time of writing this article), indicating broader investor enthusiasm across the value chain.

List of ASX Mining Companies Driving Rare Earth Exploration and Development.

Analysts say the DoD's direct stake in MP signals a monumental shift in how governments will engage with critical minerals moving forward.

“This is a game changer for the ex-China industry and a much-needed surge in magnet production capacity,” said Ryan Castilloux, Managing Director at consultancy Adamas Intelligence, via Reuters.

The announcement follows President Trump's invocation of emergency powers in March to boost U.S. domestic rare earth production and reduce reliance on Chinese supply, which has come under increasing strain amid trade tensions.

China, which produces over 85% of the world’s rare earth magnets, slashed exports by 75% last month, triggering production halts at several global auto and electronics manufacturers. The U.S.’ strategic countermeasure, via MP Materials, aims to arrest this dependence before it evolves into a national security bottleneck.

"We’re getting an important national security need met, but we’re maintaining our free market public company approach," said Litinsky on an investor call Thursday.

To fund the effort, Goldman Sachs and JP Morgan are backing a $1 billion loan for the 10X facility, while the DoD is offering a separate $150 million loan for MP’s heavy rare earth processing expansion at its Mountain Pass facility in California.

The move has underscored the strategic value of Australia’s rare earth ecosystem, with many players likely to benefit from increased global focus on non-Chinese supply.

Companies such as Arafura Resources (ARU), Ionic Rare Earths (IXR), Brazilian Rare Earths (BRE), and Australian Rare Earths (AR3) are considered well-positioned to ride this geopolitical tailwind. Exploration interest and capital flows into these players may intensify in the coming quarters.

Meanwhile, larger players like Iluka and Lynas, with advanced processing capabilities and established offtake partners, stand to gain from both elevated pricing and renewed government-to-government partnerships.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles