As investors navigate an unpredictable global economic landscape marked by easing trade tensions between the U.S. and China, falling gold prices, and resurgent investor sentiment in cyclical industries, penny stocks have emerged as an attractive asset class on the Australian Securities Exchange (ASX). Today, we spotlight three penny stocks: Clarity Pharmaceuticals, Bisalloy Steel Group, and Southern Cross Electrical Engineering, each uniquely positioned to capitalize on evolving market dynamics.

Current Price: $2.49 (up 12.16% today)

Market Cap: $800 million

Yearly Performance: -37.28%

CU6 Stock Price Chart - 13th May 2025 | Source: https://stocknessmonster.com/quotes/cu6.chia/

Clarity Pharmaceuticals is experiencing a resurgence, with today's impressive 12.16% rally indicative of renewed investor optimism. As a clinical-stage radiopharmaceutical company, Clarity is revolutionizing cancer treatment through its proprietary SAR technology, which uniquely combines diagnostics and therapeutics.

Recent developments have reignited market enthusiasm. Clarity’s ongoing Phase II SECuRE trial recently marked a significant milestone, treating its first patient in the expanded cohort. The trial evaluates SAR-bisPSMA, targeting cancers expressing prostate-specific membrane antigen—a potentially game-changing therapy for prostate cancer patients.

Despite a challenging past year marked by a substantial 37% decline, the stock is staging an impressive comeback, jumping 54% over the past month alone. Investors appear encouraged by Clarity's debt-free balance sheet, fortified by a healthy cash reserve of over AU$111 million, ensuring ample runway to progress clinical developments without immediate financial constraints.

The volatility associated with clinical-stage biotechs remains ever-present; however, given Clarity’s accelerating trial momentum and significant cash position, investors eyeing substantial upside in the biotech space should closely monitor this high-potential penny stock.

Current Price: $3.37 (up 0.60% today)

Market Cap: $161.4 million

Yearly Performance: -6.39%

BIS Stock Price Chart - 13th May 2025 | Source: https://stocknessmonster.com/quotes/bis.asx/

Bisalloy Steel Group has established itself as a robust player in high-strength steel production, offering products critical to mining, construction, defence, and infrastructure sectors globally. With today's modest 0.60% rise reflecting stability amidst market uncertainty, Bisalloy remains a steady performer.

Bisalloy’s investment appeal is enhanced by its generous dividend policy, currently yielding an attractive 9.64%. The company recently declared an interim dividend of $0.08 per share (fully franked), underscoring management's confidence in ongoing cash flow generation.

Financially, Bisalloy maintains solid fundamentals, evident by consistent earnings growth (up 14% year-on-year) and a low debt-to-equity ratio of just 3.6%. The global infrastructure recovery, buoyed by easing geopolitical tensions between major economies, positions Bisalloy ideally for renewed demand for its specialised steel products.

Although the stock has seen a moderate 6.39% drop over the past year, its resilience, attractive dividend yield, and positive industry tailwinds provide a compelling investment case. For investors seeking reliable income combined with capital growth potential from infrastructure demand, Bisalloy presents a strong proposition.

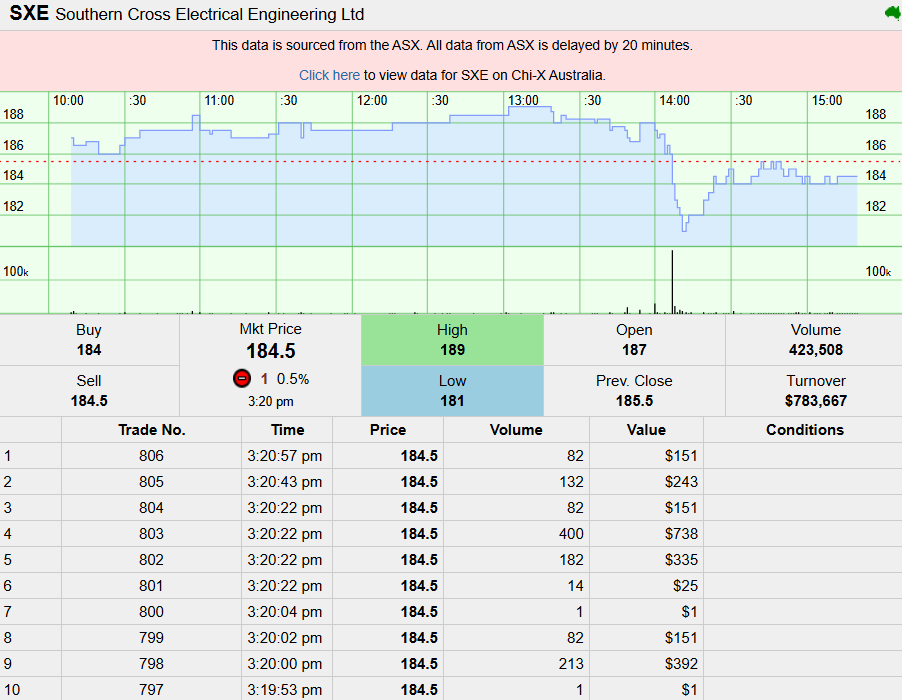

Current Price: $1.84 (down 0.81% today)

Market Cap: $486.5 million

Yearly Performance: +14.29%

BIS Stock Price Chart - 13th May 2025 | Source: https://stocknessmonster.com/quotes/sxe.asx/

Southern Cross Electrical Engineering (SXE) operates in the thriving electrical and instrumentation services sector, providing essential solutions to Australia's robust infrastructure and resources markets. Though down slightly today by 0.81%, SXE maintains a healthy 14.29% annual gain, outperforming broader market indices.

The recent strategic acquisition of Force Fire Holdings Pty Ltd for AUD 53.5 million highlights SXE’s growth ambitions. This acquisition diversifies its revenue streams, particularly in infrastructure projects, enhancing recurring income potential and operational scale. SXE remains financially robust, boasting a strong balance sheet with zero debt and substantial cash reserves of AU$114.8 million.

Analysts overwhelmingly rate SXE as a strong buy, citing its impressive forecasted earnings growth (approximately 18.8% annually). Additionally, SXE offers investors a steady dividend yield of 4.08%, making it particularly appealing for those seeking both capital appreciation and income.

SXE’s solid operational execution, strategic growth initiatives, and favourable analyst sentiment create a compelling narrative for continued outperformance. With infrastructure spending anticipated to accelerate nationally, Southern Cross Electrical Engineering is ideally positioned to capture this growth, rewarding investors along the way.

| Company | Current Price | Market Cap | YTD Performance | Dividend Yield | P/E Ratio |

|---|---|---|---|---|---|

| Clarity Pharmaceuticals | $2.49 (+12.16%) | $800.17M | -40.29% | N/A | N/A |

| Bisalloy Steel | $3.37 (+0.60%) | $161.44M | -23.76% | 9.64% | 10.12 |

| Southern Cross Electrical | $1.84 (-0.81%) | $486.51M | +17.57% | 4.08% | 17.36 |

While global and local markets digest the easing of trade tensions, ceasefires, and potential economic rebounds, investors focusing on the Australian penny stock sector can find diversified opportunities among Clarity Pharmaceuticals, Bisalloy Steel, and Southern Cross Electrical Engineering. Each offers a unique investment profile—ranging from aggressive growth opportunities in biotech, stable dividends in industrial metals, to strategic expansion in electrical engineering services.

Despite recent market volatility, particularly within the biotech space, savvy investors will find these penny stocks worthy of careful consideration. Their fundamental strengths, combined with attractive valuations and distinct catalysts, present compelling reasons to watch—and perhaps even seize—these opportunities before broader market recognition drives prices higher.

In a market often dominated by short-term noise, focusing on these undervalued, well-positioned penny stocks could yield significant returns for investors willing to embrace volatility as part of their investment strategy.

Clarity Pharmaceuticals offers the highest risk-reward proposition with its groundbreaking cancer therapies approaching significant clinical milestones.

Bisalloy Steel presents a defensive dividend strategy coupled with infrastructure-driven growth.

Southern Cross Electrical Engineering balances strong fundamentals, strategic acquisitions, and consistent dividends in a booming infrastructure landscape.

Investors seeking strategic exposure to potentially explosive growth, steady dividends, or a blend of both should closely track these penny stocks. Despite inherent volatility, their strong fundamentals, strategic positioning, and recent momentum indicate substantial potential to deliver significant investor returns in the medium-to-long term.

P.S. None of the companies mentioned above are clients of Skrill Network, and this is not a sponsored post.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles