Is Emerging as a Cybersecurity Stock to Watch.webp)

In a market saturated with cybersecurity contenders, A10 Networks, Inc. (NYSE: ATEN) is quietly but steadily carving a space as a formidable player in digital defense. The California-based company, long known for its high-performance networking and application delivery solutions, is now gaining momentum thanks to its growing focus on AI-powered cybersecurity infrastructure, strong balance sheet, and consistent execution on its growth strategy.

The company's latest quarterly results underscore this progress. For Q1 2025, A10 reported revenue of $66 million, 3.8% above analyst estimates, and earnings per share (EPS) of $0.13, which beat expectations by 24%. Enterprise revenue grew a solid 18% year-on-year, while security-led revenue rose 9%, now accounting for 63% of total revenue—a figure approaching A10’s long-term target of 65%.

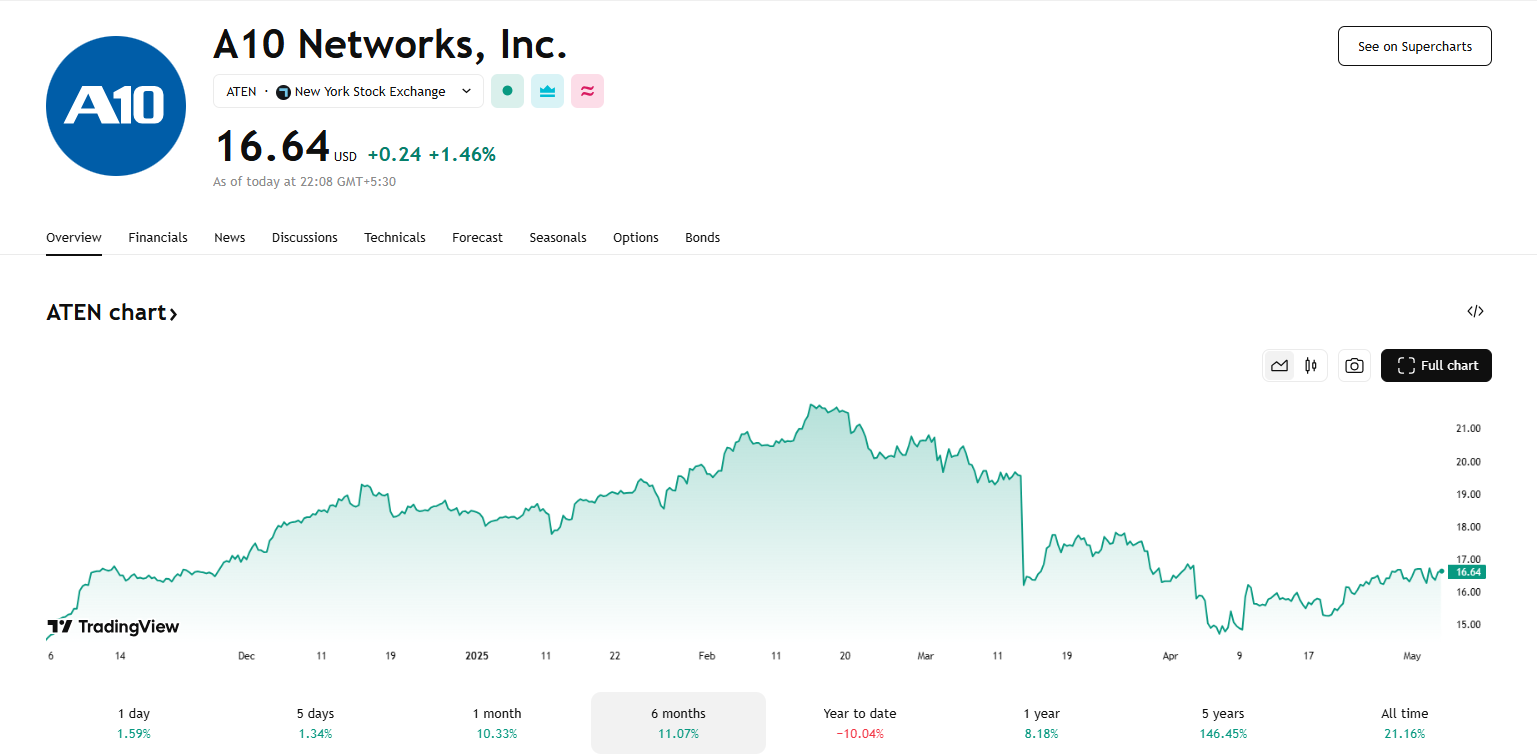

As of the latest trading session, A10 shares are up 1.55% to $16.66, reflecting a market cap of approximately $1.2 billion. The stock is trading within a 52-week range of $12.27 to $21.90 and maintains a 1.46% dividend yield, with an upcoming ex-dividend date of May 15, 2025. With a P/E ratio of 24.84 and EPS (TTM) at $0.67, the company remains attractively valued relative to peers.

A10 Networks Six Month Price Chart as of 5th May 2025 | Source: TradingView

A10’s appeal goes beyond numbers. The cybersecurity sector is undergoing a seismic shift, driven by increasing threats, the rise of generative AI, and more complex cloud-native environments. A10 is directly aligned with this evolution. Its February 2025 acquisition of ThreatX Protect, a leading Web Application and API Protection (WAAP) platform, adds advanced behavioral threat detection, bot management, and AI-driven insights to its Defend product suite. This enhances A10’s competitive edge in securing applications and APIs across hybrid and multi-cloud environments.

CEO Dhrupad Trivedi noted that the acquisition "builds a strong foundation for hybrid cybersecurity innovation" and positions the company to support the coming wave of AI-powered data centers—a theme echoed by recent customer engagement and investment activity.

According to Fortune Business Insights, the global cybersecurity market is expected to grow from $172 billion in 2023 to over $562 billion by 2032, driven by cloud migration, AI deployment, and increased regulation. A10 is well-positioned within this expanding market, with $355.8 million in cash and equivalents, allowing for both R&D and future M&A.

Moreover, A10 has been returning capital to shareholders through dividends and share repurchases—testament to its strong cash flow profile. It generated $90.5 million in operating cash in 2024 alone.

Analysts remain cautiously optimistic. The average 12-month price target for ATEN has been raised to $23.25, with a high estimate of $25.00. While revenue is forecasted to grow 4.9% in 2025, EPS is expected to decline slightly to $0.58—mostly due to margin normalization after a strong year. Still, growth expectations are improving, with A10 now projected to expand earnings at an annualized rate of 6.6% through 2025, ahead of its five-year average of 3.7%.

While this lags the 13% sector average, A10’s consistency, profitability, and growing security focus make it a standout in the under-$20 cybersecurity stock category.

A10 Networks isn’t chasing hype—it’s building value through careful execution, meaningful acquisitions, and a growing cybersecurity footprint. With strong Q1 results, a rising dividend, and increasing institutional interest (held by 30 hedge funds as of Q4 2024), the stock offers a rare blend of growth, income, and tech exposure under $20.

For investors looking to tap into the evolving cybersecurity narrative without the risk profile of unproven startups, A10 Networks is a name worth watching.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles